Environmental, Social and Governance (“ESG”) aspects of the businesses in which we invest are key considerations and are an integral part of our investment decision making process. DunPort has adopted a Responsible Investment policy to guide our investment and credit process to the companies to which we lend and the community in which we operate which we consider important to long term value creation.

Today, DunPort is a United Nations’ Principles for Responsible Investment (“UN PRI”) signatory, a public supporter of the Task Force on Climate-Related Financial Disclosures (“TCFD”) and the Paris Agreement. Download our TCFD Disclosure here: DunPort 2025 TCFD Disclosures

The following considerations are adopted by DunPort and its team:

- Assist portfolio companies with long term sustainable and ethical growth for the benefit of stakeholders, including employees, shareholders and partners;

- Encourage performance related structures, by matching business improvement and financial rewards, both internally and where appropriate within portfolio companies;

- Integrate ESG considerations with new investment appraisal methodology and ongoing portfolio management activities;

- At all times, consider and adhere to stringent anti-corruption ethics and policies;

- Manage public relations relating to DunPort and portfolio companies effectively and in accordance with the best interests of stakeholders;

- Act as a responsible steward of investors’ capital; and

- Represent DunPort, portfolio companies, investors, employees and other stakeholders with integrity

We are delighted to publish our most recent Responsible Investment policy which we will continue to review and enhance on a continual basis.

Download here: DunPort RI Policy 2025

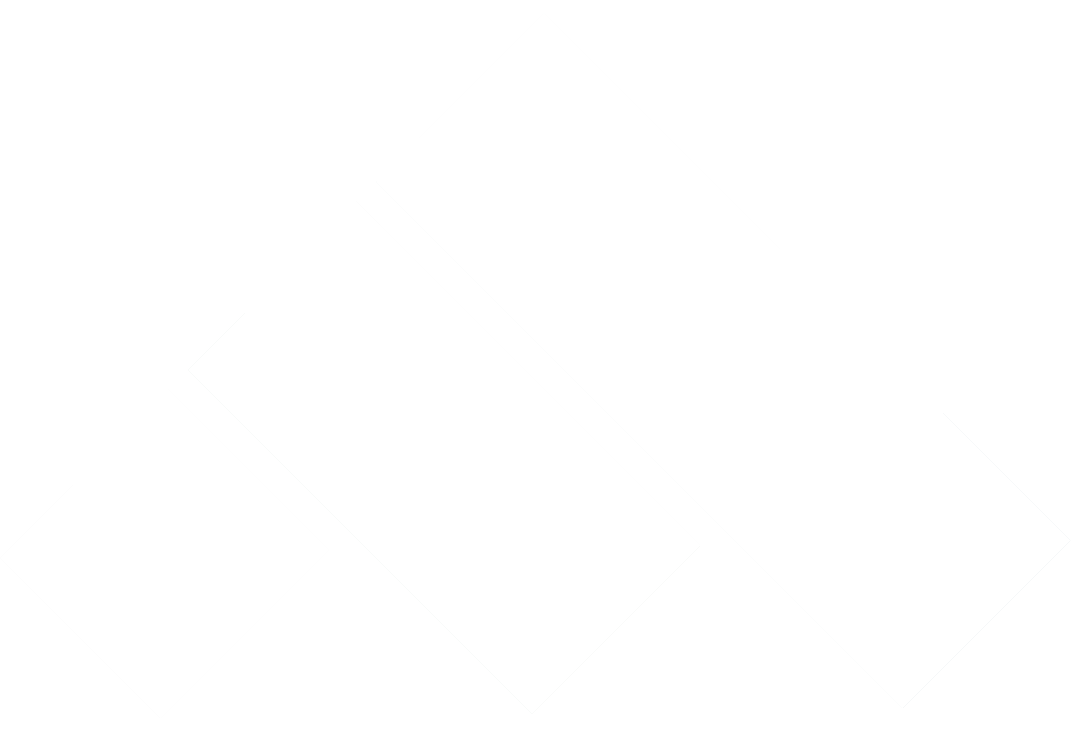

Having a clear picture of our total carbon emissions helps benchmark our climate performance and identify areas for improvement. The methodology for our Scope 1 and 2 emissions are listed below.

Our total emissions for financial year 2024 were as follows:

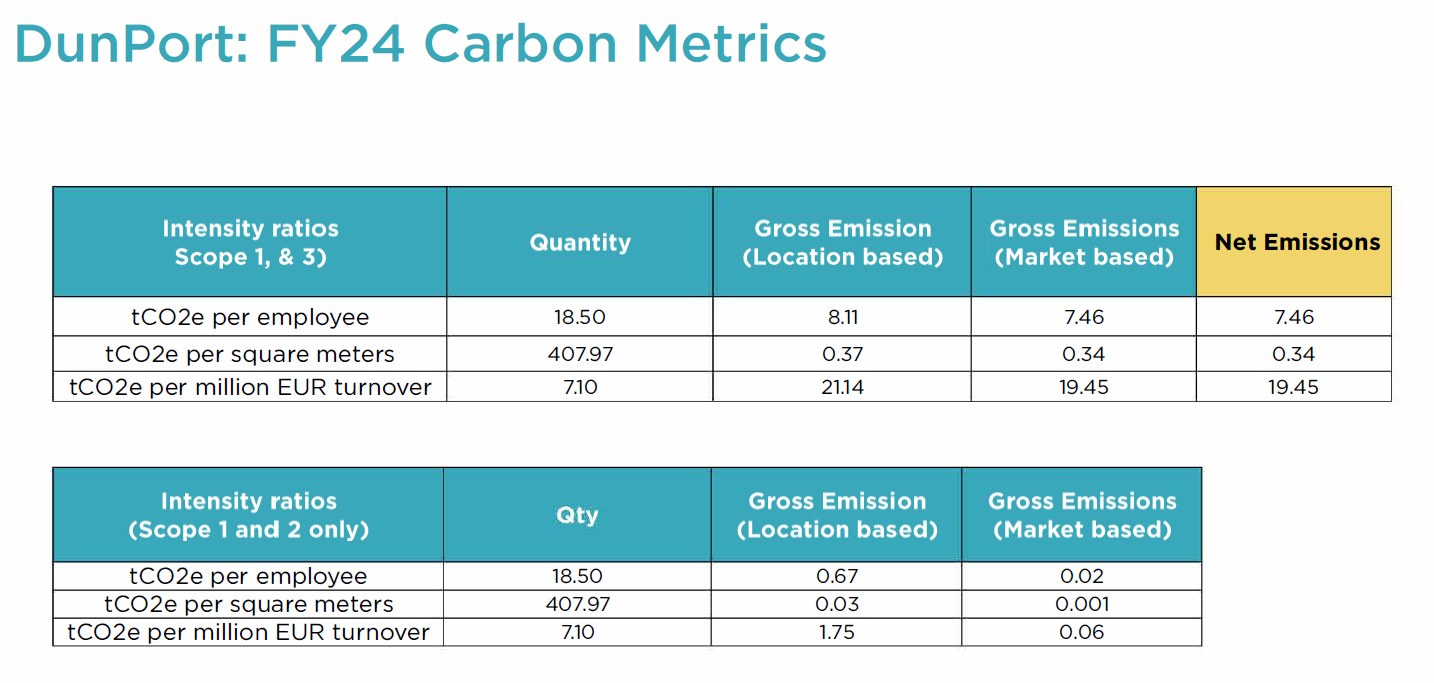

FY24 Annual ESG survey results across DunPort portfolio companies:

DunPort has calculated its GHG emissions in line with the Greenhouse Gas Protocol as set out by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD) [https://ghgprotocol.org/].

Scope 1

Scope 1 sources included in the inventory are fugitive emissions of refrigerant gases. There were no reported refrigerant leaks for Ireland. Square footage of DunPort’s operations in London were used to estimate the fugitive emissions there. Excluded from the inventory are onsite (or “stationary”) natural gas combustion and mobile fuel combustion from leased and owned vehicles. These were excluded as DunPort do not use any natural gas in their operations nor own or lease any company vehicles.

Source of emission factors:

UK Department for Energy Security and Net Zero:https://www.gov.uk/government/publications/greenhouse-gas-reporting-conversion-factors-2024

Rate of loss was derived from “The World Bank Group Emissions Inventory Management Plan for Internal Business Operations 2014”

https://documents.worldbank.org/en/publication/documents-reports/documentdetail/319541467991904684/the-world-bank-group-greenhouse-gas-emissions-inventory-management-plan-for-internal-business-operations-2014]

Scope 2

Purchased electricity was the only identified scope 2 emissions source. Per- the GHG Protocol Scope 2 and the UK Government’s Environmental Reporting Guidelines scope 2 emissions have been calculated in two ways using the location-based and the market-based methodology. A location-based method reflects the average emissions intensity of the grids on which energy consumption occurs. A market-based method reflects emissions from electricity from sources/locations that DunPort has purposefully chosen (e.g., specific green energy supply contracts, renewable energy guarantees of origin (REGO), green power purchase agreements (green PPA)). Actual electricity consumption data was provided for Ireland and estimated electricity consumption data based on actual information was provided for London.

Source of emission factors:

UK Department for Energy Security and Net Zero:https://www.gov.uk/government/publications/greenhouse-gas-reporting-conversion-factors-2024

CarbonFootprint.com International Electricity factors: https://www.carbonfootprint.com/international_electricity_factors.html

UK Grid Residual mix factors: https://www.gov.uk/government/publications/fuel-mix-disclosure-data-table/fuel-mix-disclosure-data-table